Rebuilding trust

Land Value Tax can’t solve everything - clear and radical policies are required to overcome anger and apathy. Failure to rebuild trust will lead to scapegoating, more flags on lamp posts - and far worse!

Extraction v caring

We have to change from an extraction economy to a caring economy.

An extraction economy transfers our national wealth from the majority to a minority by way of profit, rent and corruption.

A caring economy uses government spending to create a fairer society for us all.

Policies

The policies listed below are covered in detail on the rest of this page. No apologies for this being a long page - there is a lot to cover.

Summary:

Scrap Council Tax.

Scrap inheritance tax and introduce a lifetime gift allowance.

Scrap dual nationality - you are either a UK citizen or you aren’t.

Scrap non-dom status - “not registered in the UK for tax purposes.”

Separate earned income (from work) and unearned income.

Political parties to be funded by members subscriptions only.

Reform voting so “every vote counts”.

Invest in things that meet social need.

Simplify our tax system.

End use of tax havens by UK citizens.

UK citizens to pay UK taxes on all income.

No government contracts to companies registered in tax havens.

Convert trusts to companies.

End use of nominee shareholders.

Introduce Land Value Tax.

Media ownership restricted to UK citizens resident in the UK.

Create a Citizens’ Bank.

Compulsory purchase of land for social housing.

Reconsider our independent role in the world.

Rebuild our trading relationship with Europe.

Protect our environment while supporting farmers to grow our food.

Move parliament out of London.

Scrap Council Tax.

Land Value Tax can be used to replace all property taxes, including the unfair Council Tax. Revenue raised would allow national government to provide 100% of the funding Local Authorities need to meet their legal obligations.

This is covered in our article on Local authority funding.

Scrap inheritance tax and introduce a lifetime gift allowance.

We should be free to leave whatever we wish to whomever we wish.

A lifetime gift allowance (as used by other countries) allows someone to receive gifts, free of tax, up to a specific limit set by legislation.

There is more about this in our article on Fairness, equality and silver spoons.

Scrap dual nationality - you are either a UK citizen or you aren’t.

Other countries have found this tricky when questions arise about where someone’s loyalty lies in times of tension or conflict between countries.

Things become worse when MPs and government ministers have dual nationality - how can we trust their decisions, and their attitude to another country, when they are citizens of both? How can we trust someone who can simply up-sticks and live in another country by right of being a citizen there?

We don’t know which MPs have dual citizenship or the right to live in another country - no records are kept!

Dual nationality is a case of “having your cake and eating it”. As a citizen you have the rights and responsibilities associated with being a UK citizen. You can’t have rights and responsibilities in two countries when those rights and responsibilities may be different!

No one is forced to be a UK citizen. You can, if you wish, settle your affairs with HMRC, give up your UK citizenship, surrender your passport and become a citizen of any country that will have you.

But you can’t have the best of both! That’s unfair.

Scrap non-dom status - “not registered in the UK for tax purposes.”

For decades Jonathan Harmsworth, the patriotic owner of the Daily Mail., claimed to be “not resident in the UK for tax purposes” despite being resident in the palatial pile of Ferne Park in Wiltshire.

Jeremy Hunt, Conservative Chancellor under Rishi Sunak (whose wife was a non-dom) proposed removing non-dom status and this was finally implemented in April 2025 - with some short-term and long-term exceptions for the lawyers to argue over.

The patriot, Jonathan Harmsworth, still has his companies registered in tax havens to avoid UK tax.

Separate earned income (from work) and unearned income.

Most people are fed up with politicians going on about “hard working families” or “workers not shirkers” (Daily Mail and Express take note!)

However, it does seem unfair that those who do not work, who live off “a private income” (usually inherited, not earned) should pay the same tax as those who do work.

Clearly defining what is “earned” (and that would include pensions which have been earned and invested for retirement) from “unearned” would enable different rates to be set for the two.

Political parties to be funded by members subscriptions only.

We have one of the most corrupt political systems in Europe.

Corruption begins the moment a politician or political party accepts donations or free gifts - and that includes trips abroad paid for by foreign governments or by supporters of foreign governments.

Membership subscriptions, where all members pay the same, should be the sole source of income for political parties.

No politician should accept donations or gifts - no matter how laudable the cause - they should get by on their salaries and expenses.

Funding for elections can be organised based on party membership.

Reform voting so “every vote counts”.

The massive majority gained by the Labour Party in 2024 came from the lowest share of the vote in over 80 years! Labour had a far higher share in 2017 - and lost!

In 2024 64% of those who voted did not vote Labour.

In 2024 9.7 million people voted Labour - 21% of the electorate. 79% did not vote for Labour.

Tens of millions of us have never had our views represented in government.

In many constituencies a vote is pointless - a donkey representing a specific party would get in.

This is not democracy and we must reform our voting system so that every vote counts and every voice is heard.

Invest in things that meet social need.

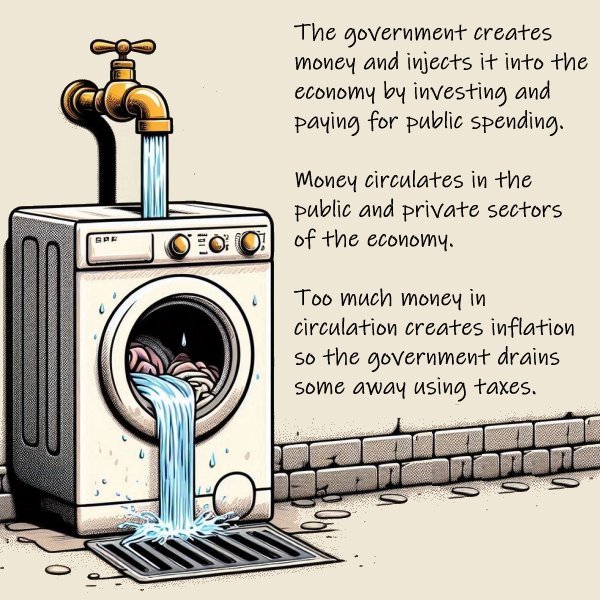

Government spending drives the economy. The government pours money in, the money circulates throughout the private and public sectors and eventually some of it has to be taken out to avoid inflation.

Government covers day-to-day spending: salaries, consumables etc. in the public sector. On top of this it invests to meet the long term needs of society: infrastructure, schools, hospitals, prisons, weapons, energy sources, environmental protection etc.

Decades of limited capital investment have resulted in a country it is hard to be proud of. Instead we have made it easy for people to make money from money through gambling and usary (the “finance sector”) and we have allowed wealth to be accumulated by the few while leaving the majority behind.

Neo-liberal economics has remained flavour of the month since the 1980s - and it has failed us because it has persuaded chancellors of all parties that the world is one way up (tax pays for things) when in reality it is the other way up (government spending drives the economy).

Governments CAN invest - they did so when they took over the railways and mines and created a National Health Service when Britain was broke after WW2, they did so to build millions of homes even when food was rationed in the 1950s, they did so when the world was brought to its knees by reckless gambling in the financial sector in 2007/8 and they did it again during COVID.

They CAN build the things we need as a civilised society - as long as they use taxation to take out surplus cash to prevent inflation. The question is how do they take it out? Do they take it from those on benefits and from “hard working families” or from the wealthy - those “with broad shoulders”?

Don’t expect Labour Chancellors to recognise this - they are in awe of big business and the “financial sector”. Sometimes they are just not very bright.

Simplify our tax system.

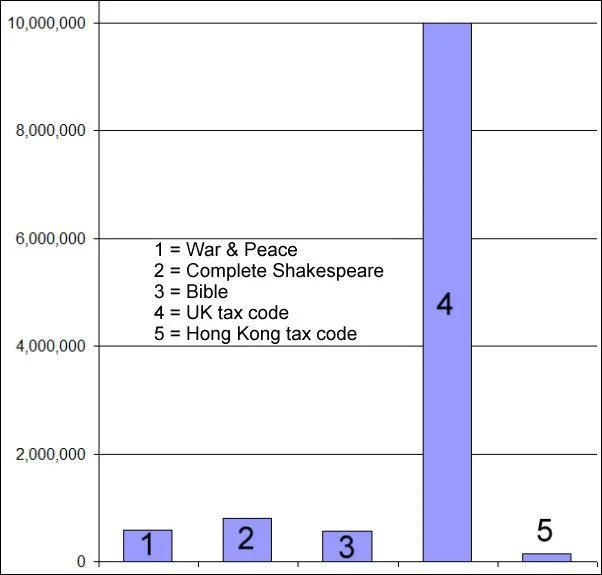

Any legal system, including the UK “tax code”, that requires lawyers to understand it is a bad system.

Our “tax code” contains over 10,000,000 words which makes it 12.5 time longer than the Bible and 12 times longer than the collected works of Shakespeare.

Almost all our laws were written by the holders of property to defend property - because, until, relatively recently (the last 100 years) they were the only ones in parliament.

Hong Kong’s tax code contains 150,000 words - making it 1.5% the size of the UK’s.

Our tax system favours those with deep pockets because they can afford the best lawyers and accountants to fiddle the system in their favour with everything from trusts to offshore companies to tax havens.

There are simple and straightforward ways to make the tax system fairer by ensuring that those with wealth contribute more. Richard Murphy’s “Taxing Wealth Report” is an excellent place to start. Simple things - so why do chancellors ignore them? The answer is that chancellors are afraid of, as well as being in awe of, big business and the financial sector. In some cases they may, like many other MPs. have their eyes on jobs in business/finance when they leave parliament - upsetting the apple cart with anything too radical is not in their best personal interest..

It is worth remembering that the “financial sector”, including those exotic things like “hedge funds”, “alternative asset managers” and “private equity funds” (remember the crash of 2007/8?) don’t generate wealth because they don’t make anything, they simply move money around hoping for the best capital growth and income return. Wealth is created by those who work, finance is the parasite that creams off wealth from those who work..

End use of tax havens by UK citizens.

The OECD’s Common Reporting Standard means that all countries, including tax havens (of which many are British!), are supposed to report back about funds they hold. In theory this means that places like the Cayman Islands and the British Virgin Islands (home of Richard Branson) should report back to HMRC about funds held by UK companies and citizens.

All of them are falling over backwards not to comply and some of them are outright refusing to do so.

Richard Murphy’s blog and videos on this topic are worth reading and watching:

"How country-by-country reporting exposed tax havens"

"Tax havens create massive economic disruption and economic inequality. We need to be rid of them."

“Tax havens exist to undermine democracy. They are a fundamental threat to our way of life.”

If the Common Reporting Standard was working there would be no point anyone putting funds in tax havens - yet, for some reason, they still do!

Something is still rotten, something still stinks.

UK citizens to pay UK taxes on all income.

Being a citizen is a two sided coin, you can’t expect the rights associated with being a British citizen without accepting the responsibilities that go with it.

One of those responsibilities is to pay tax for the common good.

No one forces you to be a British citizen. You can, if you wish, settle your affairs with HMRC, give up your UK citizenship, surrender your passport and become a citizen of any country that will have you.

The rules around foreign earnings, and working/living outside the UK, are horrendously complicated - take one look at the reform of non-dom status.

All income received by UK citizens from anywhere in the world should be taxed in the UK - with due allowance to prevent double taxation. That’s the price you pay for being a UK citizen.

No government contracts to companies registered in tax havens.

Why do we allow companies, often foreign owned, to take our money and hide it in a tax haven?

Why do we give contracts to companies registered in tax havens or who have shareholders (often other companies) registered in tax havens?

Changing this is simple - don’t give contracts to such companies. Favour companies registered and owned in the UK.

Convert trusts to companies.

There have been many attempts to reform trusts and to ensure they pay at least some tax.

However, their purpose is simple - to protect wealth and to hide ownership.

You can search Companies House to find directors and shareholders of companies - for free! (Look at the Confirmation Statements for shareholders.)

You can search the Land Registry for the freeholders and leaseholders of land - but you have to pay a fee.

HMRC knows who the trustees and beneficiaries of trusts are - but it refuses to release the information.

Converting trusts into companies, with the trustees as directors and the beneficiaries as shareholders, would bring transparency.

End use of nominee shareholders

PPE Medpro was ordered to repay £148 million for breaching its contract to supply PPE during Covid. PPE Medpro then went broke while also owing £39 million to HMRC.

None of this will ever be collected. We have been screwed.

Doug Barrowman, husband of Michelle Moon (made a Baroness by David Cameron) has made his money from selling dodgy schemes designed to avoid tax.

Barrowman “made a fortune mis-selling tax avoidance schemes on an industrial scale to people on modest incomes. The schemes all failed, leaving their clients with huge tax bills – many went bankrupt; at least two killed themselves.”

He set up PPE Medpro but he did not hold the shares, they were held by an accountant, Arthur Lancaster, as a “nominee shareholder”.

When someone looks at a list of shareholders on the Companies House web site they expect to see the real shareholders. However, it is perfectly legal to hide the identity of the real shareholder(s) behind a nominee, someone listed as owning the shares but with no control over them,

The reasons quoted to justify this are similar to those for trusts: to hide wealth, privacy and “to prevent reputational damage”. This explains why nominees are very handy if you are up to something criminal or something you prefer ordinary people to know nothing about.

Barrowman, who registers his Knox group companies in the Isle of Man (because he likes the fog?), also owns Angelo (PTC) which made a £1 million secured loan to PPE Medpro and this has to be paid ahead of paying the £39 million owed to HMRC and the £148 million ordered to be repaid to the government.

The Isle of Man, a wet and foggy island in the Irish Sea between the Lake District and Northern Ireland, is a tax haven with 0% capital gains tax, 0% inheritance tax, 0% corporation tax and 0% dividend tax for non-residents.

The use of nominee shareholders should be ended so we know who are the real directors, shareholders and beneficiaries.

In the meantime, Barrowman and Moon are entertaining their friends while cruising the Mediterranean in their shiny new £50 million yacht and laughing their heads off.

Note

PPE Medpro is one company - there is another, PPE Medical Protection Limited where Arthuir Lancaster is listed as a Director. In fact Arthur Lancaster is listed as a director of 17 companies, some no longer in business. One still in business is one of Doug Barrowman’s other companies, Knox House Trustees (UK) Limited. Another is Pitch@Palace Global Limited where Andrew Mountbatten Windsor, the man previously known as HRH Duke of York. is listed as a Person With Significant Control. No doubt Arthur is charging hefty fees for his nominee services.

There is a faint whiff in the air - like opening the top of a septic tank!

Introduce Land Value Tax.

That is the whole purpose of this site - so start here!

Media ownership restricted to UK citizens resident in the UK.

Why do we allow foreigners to own our media to tell us how we should run our country?

Why do we allow foreigners to influence our elections by buying their way into our mass media?

Restricting media ownership to UK citizens, living in the UK and registered for tax in the UK, will help prevent outsiders telling is what to do!

Create a Citizens’ Bank.

On the Sunday 7th September 2008 many people in Derbyshire awoke to find that “their” building society, the Derbyshire Building Society, had gone broke. By the following morning it was announced that the Derbyshire would be merged with Nationwide.

Why had it gone broke? Because the directors became involved in the sub-prime lending scandal in the USA. A small, local, English building society, whose members trusted it to look after their savings while offering mortgages to local people, bought packages of loans put together (“securitised”) by “clever” bankers (the English word is “crook”) in the USA Did the directors of the Derbyshire understand what was going on? No - but they became greedy, jumped on a bandwagon and left it to their “technical people” who in turn left it to the “quants” in New York’s Wall Street banks.

Note

The work of quants, and their complex mathematical models designed to minimise risks (banks hate risks!) and maximise profits, is a classic illustration of why the financial sector is a parasite.

“Investment” companies, and banks, would like you to believe they are like Mr Manwaring (”Captain Manwaring”) of Walmington-on-Sea. His bank, “Swallow Bank”, took deposits from local savers and leant that money to local businesses like Lance Corporal Jones’ Butcher Shop.

“Investment” companies don’t go along to see company owners, to see the products being developed, to see the market for those products. Instead they create mathematical models to minimise risk while maximising gain through the ebb and flow of share prices which have almost nothing to do with the underlying validity of companies and their products. The current (November 2025) AI bubble is a classic example. Those who employ quants don’t understand the models created by quants - they can only be understood by other quants!

This is madness. These people, and the companies that employ them, are not creating wealth by making things or working for the social good. Instead they are gambling with wealth created by those who work. Every billion extracted by these companies is a billion off the wages of those who work.

On 14th September 2007 the Northern Rock bank sought help because it was in trouble. On 22nd February 2008 it was nationalised.

In October 2008 the government was forced to take a 58% stake in Royal Bank of Scotland and a 43% stake in Lloyds to prevent them going under.

At the peak of the 2007/2008 banking crisis the UK government had committed over £1 trillion by way of cash injections (£133 billion) and guarantees.

Following the crash rules were introduced to prevent this sort of thing happening again.

In 2025 the Labour Party chancellor, Rachel Reeves, announced that she was easing the rules on banks and the City to remove “red tape” and “stimulate growth”. (Banks don’t “stimulate growth” - they are profit seekers who lend at interest and gamble for profit.) At the time of the crash Reeves was working in the Customer Relations Department at Halifax Bank of Scotland. She has never been a “banker” but she is very close to banks and the “financial sector”.

Reeves has set the scene for the next big financial crash.

Can we really trust banks and financial institutions?

No.

Those who can’t trust banks would be very happy to put their money where all of it, without limit, was guaranteed - the only thing that can do that is the government.

A Citizens’ Bank bank would accept salaries and savings and provide all the normal banking services (including mortgages) except a credit card. Like National Savings, a Citizens’ Bank would pay a reasonable rate of interest on deposit and term accounts. Those willing to take more risk would remain free to put their money in commercial banks.

The government can’t go broke so those in Derbyshire who worried in the 24 hours of September 7th/8th 2008 can feel secure at last!

Interesting question

Where did the £1 trillion of funds come from to provide cash and guarantees to the financial sector?

Those who believe “tax pays for things” have a problem here.

Does anyone remember getting an email or letter from the chancellor, Alistair Darling, asking them to cough up £26,737 (£1 trillion shared by 37.4 million taxpayers) to help the banks? Did the government instantly raise taxes to get the money? Did the government pop out to the bank to borrow the money? (Oops, it was the banks that were going under …)

No. So where did it come from?

It probably came from the same place as the £313 billion injected into the economy during Covid. The government simply created the money and injected it into the economy. The bad news is that the incompetents in the Boris Johnson government failed to put in any checks - billions were ripped off by their chums - including Michell Moon and Doug Barrowman who have dodged paying anything back by ensuring that the company involved, PPE Medpro. went broke after they ran off with the money. What do they care, they have their shiny new yacht to enjoy.

Compulsory purchase of land for social housing.

The UK government and local authorities started to build millions of homes in the 1950s when the government was broke and rationing was still in place.

Huge estates, like Chelmsley Wood near Birmingham Airport, were built to replace homes destroyed in the war and to move people out of inner city slums. This pattern was repeated across the country.

Chelmsley Wood was built on land that was compulsory purchased by Birmingham City Council.

Green spaces need protection and the priority most be to build on brown field sites and where buildings are no longer fit for purpose - like some of the tower blocks in Chelmsley Wood!

There are between 600,000 and 700,000 unoccupied homes in Enland alone. A dramatic increase in Council Tax (or, even better, a huge supplement on Land Value Tax) would persuade freeholders to bring them back into use or sell.

That still leaves demand for more homes and the priority should be for local authorities to build social housing for rent using compulsory purchase and loans from the government or the Citizens’ Bank.

Reconsider our independent role in the world.

The UK army is short of soldiers.

If the “Farage Patriots” who plastered the country with flags on lamp posts in October 2025 joined the army, or their local TA, the army would be at full strength. Could it be that those “patriots” draw the line at having their legs blown off in battle or being blown to pieces by a drone controlled by someone 50 miles away? Climbing lamp posts is easier than going over the top!

Sad to say but there are still people who go on about the “glory days of the empire”. There never were any “glory days” for working people, the ones who provided the canon fodder and died in needless wars.

We are a small island with a “colourful” history, a fairly large population and a collapsing infrastructure - mainly because we were first with the industrial revolution and because the heart of many of our cities got bombed flat in WW2. This still shows in many of our large cities along with the tasteless and corrupt ways they were rebuilt after the war - everything done on the cheap - because that’s all we could afford at the time. Compare that to how many European cities were rebuilt.

We have always been a trading nation and, like the USA today, in the past we used force to ensure our companies could profit from trade (theft in cases like the East India Company) everywhere in the world. Today the USA is determined to “keep the world safe for Coca Cola and big-oil”, in the past we tried to do the same for our companies.

Peace is always better than war. Discussion is always better than force.

We are a mature country (unlike the USA) so we can act maturely. We can be peacemakers, not warmongers. We can take the lead in making the world a better place for us and for everyone else - we don’t need to be the world’s policeman to do this and we don’t have to blindly follow the USA in everything we do.

Our current record, even after Iraq, is not good. Supplying weapons to Israel, assisting Israel with military surveillance, sending missiles to Ukraine (after our Challenger tanks proved to be “not fit for purpose”), running missile targeting and control for Ukraine, fantasising about operating “no flight zones” or putting “boots on the ground”. Where are our efforts at peace?

We have to stop seeing “enemies” everywhere. Russia wants to sell us cheap gas and oil (which the USA cut off by destroying Nordstream so it could sell expensive gas to Europe) while opening its markets for our products - despite us sending 57,000 troops to fight against the Russian government between 1918 and 1920. China wants to trade with us - despite our appalling record in China during the 19th century. Venezuela has huge oil reserves and wants to sell that oil to benefit its citizens. Unfortunately Venezuela wants to do this without handing everything over to American companies - it has looked at South America’s 20th century experience with the CIA, and with companies like The United Fruit Company (now Chiquita), and said “no thank you!”.

If we are looking for the real bogeyman we need to look directly westwards, not eastwards.

Rebuild our trading relationship with Europe.

Brexit has been a huge success.

The UK has the lowest energy prices in Europe.

The cost of living has fallen by 2.3%

£350 million extra is being invested in the NHS every week.

There are no queues in A and E.

Everyone can get a same day appointment with a doctor.

Mortgage costs have fallen to under 1%.

It is now easier than ever for businesses to trade with Europe.

The British fishing industry is booming.

British farmers have never had it so good.

British people are queuing up to harvest cauliflowers and strawberries.

and British pigs have learnt to fly.

Wouldn’t that be nice.

In fact UK exports to Europe fell by 27% between 2021 and 2023 and many small businesses have given up selling to Europe - it is just too much hassle. The Office of Budget Responsibility estimates that the long term impact will be a 4% reduction in our productivity and a 15% reduction in our trade with Europe - previously our largest trading partner. Trade deals outside the EU will have a negligible impact - a 0.1% increase in our GDP. Trade creates business. Business creates jobs. Less trade means fewer jobs. We have shot ourselves in the foot.

It has been a shambles and most people in the UK, including farmers and fishermen who voted for it en masse, are worse off now than they were in 2016!

We need trade. We need a sound trading relationship with Europe. We want our young people to carve careers in Europe. We want good people from Europe to work here.

We need all these things - and it can be done.

Protect our environment while supporting farmers to grow our food.

Quite rightly we have moved away from paying farmers a subsidy based on how many acres they farm, but we have failed to replace it with anything that enables them to farm well (in the best interests of land and animals) and make a decent living. After doing the sums, most family farmers work for less than half the minimum wage!

We need good quality food and we want our countryside looked after. Farmers want to do both.

We have started the process of creating a balance between food and stewardship but a short chat with a farmer will quickly demonstrate that we have a long way to go.

It is worth remembering that 63% of our rural land is farmed by tenants, not by land holders, and today, thanks to changes in legislation, they have little or no security of tenure. Why should they invest if it can all be taken away from them? The view of Peregrine Cavendish, living off rent from 70,000 acres at Chatsworth and elsewhere, is not the same as a working tenant farmer!

Move parliament out of London.

Politicians live in the Westminster bubble - craving to be invited onto a TV programme or to be interviewed by Channel 4 in the lobby or by newspapers, magazines or podcasts.

Politicians are London-centric. Many of them don’t start out that way but they become institutionalised, surrounded by wealth while walking along Bond Street. They are “where it’s at” but they lose contact with the world outside the bubble.

Many government functions have moved out of London - it is time to keep politicians’ feet on the ground by moving parliament to Birmingham, Manchester, Sheffield or Leeds.