Fairness, equality and silver spoons

“A word that leaves my mouth may have a completely different meaning when it reaches your ear.”

Words we use every day can sometimes be difficult to define in ways acceptable to everyone. Since we claim that Land Value Tax is simple, fair and impossible to avoid, we must be clear about what we mean by “fair”.

The Fairness Foundation has excellent illustrations of what is fair and what is not.

Equality

“Of course we are all equal! I am free to take my string of polo ponies to Cowdray Park and to moor my yacht at the Quai des Milliardaires in Antibes and you are equally free to do the same!”

The idea of a level playing field, where we each stand an equal chance of succeeding, is understood by everyone but is far from the reality of life.

Every parent wants to do the best for their children by giving them a good start in life and helping when they hit bumps in the road. However, it is blindingly obvious that a child from a poor or deprived background, attending a local primary and secondary school, is unlikely to have the same start in life as one from a wealthy background attending Eton, Harrow, Winchester, Repton, Uppingham or other public school. Private education may or may not be better academically than state education but it certainly provides pupils with a level of personal confidence, and a social network, that gives them a major advantage in life.

Silver spoons

“Hard work, sir, I can respect, but only cads and bounders demand respect by virtue of being born.”

Having had a fair or unfair start in life it is reasonable to expect that each of us contributes positively to society to the best of our ability.

This is where the moral and political dimension enters the discussion.

Is it morally “right”, or socially acceptable, that someone contributes nothing to society other than ensuring that their position of wealth and privilege remains intact – often by finding ways to avoid paying tax?

Can we talk of “equality of opportunity” when someone becomes rich and leads a life of idle leisure simply because they were born?

Should someone be judged on their merits rather than the size of their parents’ wallet or the value of their country estate and landholdings?

Silver spoons come in two forms.

Old money usually has vast estates - some stretching back to the Norman invasion of 1066. Old money has enough money to ensure it can pass wealth from one generation to the next without paying tax. Old money tends to keep a low profile and avoids bling. Old money would not be seen dead engaging in the “mine’s bigger than yours” competition for fibre glass superyachts!

New money is rather less subtle in its ostentation.

“The 29-year-old is mostly famous for spending her father’s money.”

Politicians are in awe and fear of both old and new money (because money buys undue influence in our society) and some of them go on to compete in the wealth stakes.

You’re just jealous!

No, we are just angry!

We are angry with those who go our of their way to avoid contributing to society.

We are angry with those who attempt to hide their wealth in tax havens.

We are angry that those with wealth employ clever (and expensive) tax avoidance advisors while those on PAYE don’t. We want to make tax avoidance advisors redundant!

We are angry with tax avoidance advisors who promote schemes to avoid tax.

We are quite happy for people to enjoy the benefits of their own inventiveness, creativity and effort. We draw the line when they try every trick in the book to avoid their social responsibilities.

We get annoyed when some of the richest people in the country have the brass neck to complain when a government attempts to put an end to their deliberate tax avoidance.

Some of us have invented things, set up companies, employed people, made things, sold things world wide, been very successful and paid our full share of taxes. We have no need to be jealous but we have every right to feel outraged by those who contribute nothing, live off inherited wealth and avoid paying tax.

Creating a level playing field

Reforming our tax system is the simplest way to create a level playing field.

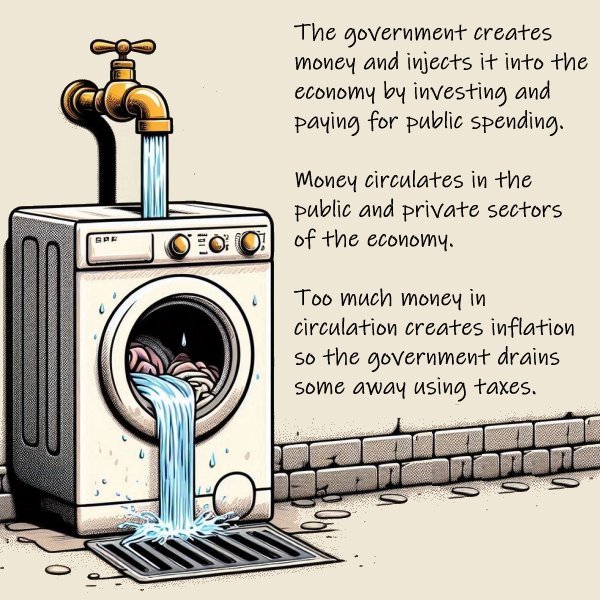

Governments have to spend: they inject money into the economy by paying for pensions, the health service, benefits, education, the police, roads, foreign governments, nuclear weapons, foreign weapons, spies, etc.

Government uses taxes to drain money out of the economy to prevent inflation.

It doesn’t really matter which taxes are used, as long as money is taken out of circulation.

Under pressure from the wealthy, governments have tried taking a flat rate poll tax from everyone so the rich pay the same as the poor. In 1381 this led to The Great Revolt and in 1990 it led to rioting on the streets and ultimately to the fall of Margaret Thatcher.

It therefore seems reasonable that taxes should be fair by taking the same proportion from those with the most as from those with the least.

Our current system is regressive - the less well off pay a higher proportion of their income on tax than those better off. VAT and Council Tax are the most regressive taxes.

Enabling people to keep more of their earnings does two things:

it encourages people to work since every penny they earn goes into their pockets.

it encourages them to spend - and this has a knock-on effect on the rest of our economy.

Making tax fairer

Separate income earned from work (PAYE, self employment, pensions) from unearned income (rents, bonuses, dividends, capital gains, interest, etc.)

Increase the zero rate threshold on earned income to £50,000 then 20% up to £100,000 and 40% thereafter.

Set a flat rate of 40% on unearned income over £50,000.

Restrict pension tax relief to the basic rate for income tax - 20%.

Reduce VAT to 10%.

Scrap Council Tax and Business Rates.

Abolish all artificial attempts to interfere with the housing market: Help to Buy, Right to Buy etc. These simply boost developers’ profits.

Allow Local Authorities to Borrow To Build using compulsory purchase of land when necessary.

Repeal the 1961 Land Compensation Act and limit the increase in value of land when it acquires planning permission for development The limit set at two times current use value.

Introduce a personal lifetime gift allowance of £500,000. Once gifts, from whatever source, exceed this threshold they are treated as unearned income and taxed at 40%.

Scrap Inheritance Tax in favour of a lifetime gift allowance (see below).

Convert all trusts into UK registered companies, Trustees become directors, beneficiaries become shareholders.

Repatriate all funds held in tax havens by UK citizens and residents.

Consider changes to other taxes or leave them unchanged.

Introduce Land Value Tax at a level required to bring in the remaining amount the government needs to take out of the economy to keep inflation under control.

Abolition of inheritance tax

People should be free to do what they wish with the money they have earned - even after death! They can leave things to organisations (the local animal sanctuary, wildlife trust, Macmillan Cancer Support, RNLI, church, National Secular Society, etc.) or to individuals.

Income received from wills is unearned and will be taxed accordingly.

Introduction of a lifetime gift allowance

Is it fair that someone can lead a life of idle leisure simply by being born?

Some people contribute to society by earning a living, others don’t.

Should tax be structured to favour those who work, rather than those who don’t?

A lifetime gift allowance (LGA), set at something like £500,000 now and rising annually by the cost of living, would still enable wealth to be passed as gifts from generation to generation but would ensure that society benefits from tax on those gifts.

Important note

LGA doesn’t prevent anyone receiving any amount from a will. Despite what The Daily Mail will say, it doesn’t confiscate an inheritance!

If your parents leave you £20 million you will pay tax on £19,500,000 (assuming you have not used up your £500,000 LGA). The top rate of tax is 45% so you will receive £10,725,000 plus the £500,000 allowance. £11,250,000 in your pocket after tax is not bad for simply being born!

Someone may leave £20 million split between three children and five grand children. Assuming each of them has not used up their LGA each would pay tax on £2 million (£2.5 million minus the £500,000 LGA). At 45% this would leave each £1.1 million plus the original £500,000 - £1.6 million. Again, not bad for the effort of being born.

Double taxation - nonsense!

The Daily Mail will also argue that this is double taxation because your parents will have already paid tax on their income before leaving it to you. This is nonsense.

When you pay a plumber to install new radiators that plumber will be taxed on that income - which you have already paid tax on. This is not double taxation, this is the way the system has always worked.

Think of it this way. Your parents paid tax on income they earned - and they can do what they like with it - pay plumbers or leave it to you. It is only fair that you pay tax on income you didn’t earn.

Political reality

The Labour government of 2024 came into power with a huge majority (though with less than 26% of the electorate turning out to vote for it) but without the very popular policies it had in 2017. The turnout in 2017 was almost 69% (the highest ever) but in 2024 it had dropped to less that 60%. In 2017 Labour got 12.9 million votes, in 2024 it got 9.7 million - a loss of 3.1 million votes.

People were fed up with austerity and with the Conservatives so those who bothered to vote Labour did so even though they believed the party had no policies. Hope had turned to despair.

Within six months of Labour taking power it became obvious that the party had no vision, no passion to make things fairer - it simply didn’t understand that it is in charge, that it is supposed to show leadership and it is supposed to introduce changes that make our society fairer. It runs on the advice of full-time political “advisors” who have done nothing except play politics since leaving school - none of them have been involved in the real economy: making things, employing people, getting things done! The chancellor in particular has failed to grasp how the economy really works and how she has the power to bring about radical change. She is timid in the face of big business, the City, hedge funds and “global investment companies” that now control the world.

The above list of changes is therefore unlikely to come about so our proposal is limited to scrapping Council Tax and Business Rates and setting an LVT rate that will allow government to provide 100% of the funds Local Authorities require to provide the services we need.