“Simple, fair and impossible to avoid”

LVT is an annual, nationally determined, nationally collected, percentage tax, paid by the freeholder, on the open market value of all land with no exceptions.

Land Value Tax is:

Simple to understand - a tax on land value, not on homes and gardens like Council Tax.

Fair - those with most, pay most. 83% of us will pay less under LVT.

Impossible to avoid - you can't hide land in a tax haven and there are no exceptions!

Straightforward to implement.

Initially a replacement for existing taxes which are complex, unfair, and easy to avoid.

You can help to promote Land Value Tax and end the unfairness of Council Tax. Our contact page shows how and tells you about us.

You can also find us on Bluesky.

Why do we need LVT?

Our tax system is unfair and we have a crisis in democracy. We have the most unfair distribution of wealth in Europe and we have lost trust in our political system.

“The Norwegian government enjoys a high level of trust compared to other countries. I believe that is related to low inequality."

Trygve Slagsvold Vedum, Norwegian Minister of Finance, 23rd October, 2024.

This site

This site is a resource for anyone promoting Land Value Tax. It is not politically affiliated because LVT has supporters across the political spectrum. Please drop us a line if you have questions or if you would like us to provide additional articles.

What is the “value” that is used for Land Value Tax?

The value of anything is what someone will pay for it. The “open market value” of land (how much it would make if it came on the market) changes over time and depends on where it is and what it can be used for.

Please read the article “Taxing value not land” for more details.

Wealth and land

There is talk about the possibility of introducing a wealth tax based on a percentage of “net asset value” with various percentages being floated about- 1% over £10 million, 2% over £1 billion etc.

Taxing wealth is a good idea - but not like this!

We cover this in detail in our article on “Wealth taxes”.

A wealth tax based on net asset value has never worked as expected where it has been tried (most countries have given up), it is very easy to avoid (people can move themselves or their assets - or they can simply lie because it relies on self-reporting), it is impossible to police (does HMRC employ an Under the Bed Squad?) and it brings in a fraction of the amount anticipated because wealthy people are good at avoiding tax - they have had lots of practice. Such taxes are a job creation scheme for lawyers and those with the greatest wealth will employ the cleverest lawyers who will drag things through the courts for years - costing us, as taxpayers, a fortune! It will end in tears!

Land Value Tax requires no self-reporting, no paperwork and no lawyers because it is simple, fair and impossible to avoid. Freeholds are registered by the Land Registry and, no matter where the freeholder happens to be (British Virgin islands, Switzerland, Monaco …) they still have to pay.

You can’t lie your way out of Land Value Tax!

Change requires action - so please write to your MP to explain why asset-based wealth taxes won’t work and why Land Value Tax will work because it is simple, fair and impossible to avoid. MPs can’t be experts in everything so by writing to your MP, and informing them of the advantages of Land Value Tax as the only successful wealth tax, you help them to concentrate on a solution that will benefit us all.

Want to discuss it further? By all means ask us questions, but why not join a local political party (of your choice) and discuss it with them? Solutions to our problems can only come through politics - there is no other way.

Notes about land

“Property” (as listed on Rightmove) is land plus everything on it – buildings, sheds, plants etc.

You can “own” the buildings etc. but you can’t “own” the land itself - you can only “hold” it under “freehold”. (Ask a lawyer about “free and common socage”!)

We, as a society, “own” all land – through “the crown”. (See here.) This has been the case since William of Normandy decided he owned it all - personally! These days this doesn’t mean Charles Windsor “owns” it all personally – he is head of state, our state! Your right to hold land can be taken away: confiscation of criminal assets, compulsory purchase, dying with no heirs.

We, as a society, control the use of all land through the planning system.

There are no “landowners”, there are only “landholders”. We are the sole landowner.

This is an important legal distinction – we, as a society, should benefit from the use of our land.

Land represents 60% of our national net worth - £7 trillion out of £12 trillion in 2025.

Over 50% of our land is held by less than 1% of the population. (*)

Over 30% of our land is held by the aristocracy: monarch, dukes, marquesses, earls, viscounts, barons. (*)

Over 18% of our land is held by corporate entities: companies, investment funds, hedge funds.

Less than 5% of our land is held by home owners.

64% of our agricultural land is farmed by tenants paying rent to landholders.

As a finite resource land is the preferred investment for the wealthy - they can live off rent and use it to avoid tax.

* much of this is held in trusts, in the UK and in tax havens, to avoid tax.

In England 4% of land is dedicated to grouse moors - almost as much as is under homes (4.9%).

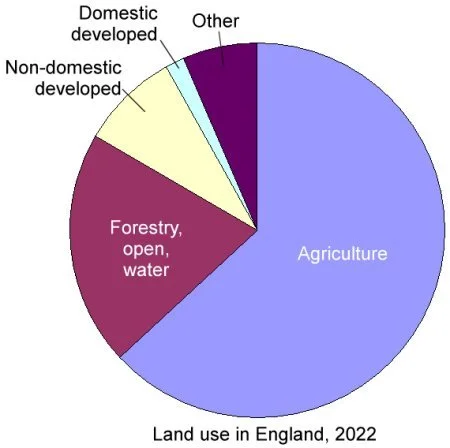

In England 63.1% of land is used for agriculture, 20.1% is forestry, open land and water, 8.7% is developed.

In the UK as a whole 1.8% of land is dedicated to golf courses.

Sources of data.

The data we quote comes from government reports, books or places like the Office for National Statistics (ONS).

Some of this “data” consists of informed estimates. That’s why we need to lay the foundations for a fairer future by immediately “Preparing for LVT - getting the facts”.

Preparing for LVT - getting the facts

We propose that the government immediately begins “Preparing for LVT - getting the facts” because:

it can be done now, straight away, immediately,

it doesn’t require a manifesto commitment to implement LVT,

it can be done in a very short time - between one and two years,

it is not expensive - the resources and skills are available.

it provides the data for decisions to be made.

We can start laying the foundations for a fairer future!

Implementing LVT - the proposal

Following a two year preparation period:

On day one:

Government will provide the funds required by Local Authorities (LAs).

HMRC will collect Council Tax, Business Rates (*) and LVT.

Over the next ten years:

Council Tax and Business Rates (*) will be phased out as LVT is phased in.

LAs may add local supplements if they wish.

Those unable to pay the difference between Council Tax and LVT will be able to defer paying the balance until property is sold or transferred.

Notes:

Phasing over ten years means there will be no sudden changes.

Deferment means that no one will lose their home or be forced to move because of LVT.

The final LVT rate will bring in the equivalent of that previously provided by Council Tax and Business Rates (*).

* the question of which taxes LVT should replace remains open and is discussed in our article “What is LVT?”

Introducing LVT

The short video below (2 minutes) covers the key points about LVT. The remainder of the site goes into more details, answers common questions and responds to possible objections. We recommend reading the articles you can find by selecting the “About LVT” menu item at the top of this page. The site is best viewed full screen if you are using a PC.

Articles About LVT

The Good Vs. The Bad

Good Taxes

Simple, short and straightforward - you don't need to consult a lawyer to understand them.

Fair. They are progressive - those with most, pay most.

Impossible to avoid. Tax Avoidance Advisors can't get round them.

Land Value Tax is a good tax: simple, fair and impossible to avoid.

Bad Taxes

Complicated. Hundreds of pages long and requiring expert lawyers to understand them.

Unfair. They are regressive, like VAT and Council Tax, because they favour the wealthy by taking a larger share of income from those who are less well off.

Easy to avoid - that's why we have the world's largest tax avoidance industry and why the UK and its dependencies are the world's favourite tax havens.

Frequently Asked Questions

-

The freeholder pays the LVT, not the leaseholder.

-

Yes. There may be national or local supplements added to the LVT rate.

-

No. None.

Exceptions create loopholes. Loopholes generate avoidance. Loopholes generate "special cases". Loopholes create court cases. Loopholes become expensive. Lawyers Love Loopholes.

LVT is simple, fair and impossible to avoid - as long as there are no exceptions.

LVT generates tax revenue - governments decide on spending.

"Special cases" should not be considered when collecting tax - however, they can be considered when spending.

Examples:

Government might decide to subsidise sheep rearing on hill farms to compete with cheap lamb from New Zealand. It can do this with a subsidy, not with a tax exemption.

Government might want to encourage people to insulate their homes to reduce energy consumption and emissions. It can do this with a subsidy, not with a tax exemption.

-

Yes. LVT is payable on all land in the UK and on land outside the UK owned by UK citizens, residents or companies.

To prevent double taxation any property taxes you pay in Spain will be deducted from the LVT due.

The largest landholder in Scotland is Danish - he pays LVT on his Scottish estates in Denmark - not Scotland.

-

In general there are two types of taxes:

A regressive tax takes a higher percentage from those with the lowest earnings and with the lowest wealth.

A progressive tax takes a higher percentage from those with the highest earnings and with the highest wealth.

LVT is a progressive tax.

Objections

Answering the most common objections

LVT is not a garden tax - Council Tax is a tax on homes and gardens.

LVT will not cause overdevelopment - our planning system prevents that.

LVT will not destroy farming, our food supply, our countryside or our wildlife -

our subsidy system will ensure that farmers are supported to do what we need.

Over 83% of us will pay less with LVT than we do with Council Tax.

Less than 1% of us will pay >10% more than we do with Council Tax.

LVT will be phased in over 10 years - there will be no sudden changes.

There will be plenty of time for the market to adjust.

Those who cannot pay any increase over Council Tax will have

the option to defer payment until the property is sold or transferred.

No-one will have to move home because of LVT.

Replacing Council Tax

Council Tax isn’t fair. In 2024/25:

a dilapidated cottage in South Derbyshire on band D pays £2,158.

a band D home in Westminster pays £973.

a £95,000,000 mansion in Westminster on band H pays £1,946.

A £95 million mansion pays less than a dilapidated cottage!

LVT is fair – those with the most, pay the most.

LVT can replace Council Tax and Business Rates.

Local Authorities have lost over 40% of their funding since 2010 resulting in poor services and potholes!

LVT will ensure that Local Authorities receive 100% of the funds they need to provide the services we share.

Update January 2025

“The Holme” in Regent’s Park was on the market for £250 million and has been sold for £139 million.

It is on band H so pays £1,946 Council Tax.

You may like to check what band H pays in your area.

Why don't we have LVT now?

Over 80% of us will pay less with LVT than with Council Tax. About 1% will pay over 10% more than with Council Tax.

That 1% includes:

major landholders, including the aristocracy, whose land will be taxed for the first time,

those who have purchased land using Business Asset Rollover Relief or to avoid paying Inheritance Tax,

Property developers who have nothing to gain from bringing an end to the escalating cost of land.

All three groups have poured millions into political parties and MPs to ensure their interests are protected.

Should fear of the powerful 1% stand in the way of something that will benefit the majority?

LVT will be phased in over 10 years to enable people, and the property market, to adjust. There will be no sudden increase when LVT begins to be phased in and deferred payment will ensure that no-one will have to move home!

The experience of Norway

From a speech made in the USA by Trygve Slagsvold Vedum, the Norwegian Minister of Finance, on 23rd October, 2024.

"I am a farmer and politician ... it is an honor for me to speak about taxing the riches of nature and sharing the prosperity from natural resources.

Our constitution was written down in 1814, in it, we got rid of our nobility, and ensured sovereignty of the people. We secured national control of our assets, our natural resources, and later taxed the income from them, to benefit the whole Norwegian people.

The story of my nation has been greatly shaped by our natural resources and the opportunity to share their values with society as a whole - not just a lucky few.

This has made it possible for us to provide quality welfare services to our citizens. Free healthcare, free education and a safety net for those who are less fortunate in life. This has led to a generally low level of inequality in Norway. The Norwegian government enjoys a high level of trust compared to other countries. I believe that is related to low inequality."

Get in touch

If you’d like to share your LVT advantages, objections, questions, or simply want to say hello, use the button below to fill in the form and contact us.