Why tax at all?

Utter nonsense!

The belief that “tax pays for things” ends up with chancellors who tell you that running a national economy is the same as running a household budget so we get “fiscal rules” and panic about “the national debt” and the power of “financial market”. This nonsense has been used to justify austerity while cutting investment and benefits. The result? An increasing wealth gap by making the rich even richer.

Where did Gordon Brown (the man who first made up the “Fiscal Rules”) get the money to bail out the banks when their irresponsible gambling crashed the world economy in 2007/2008? Did he increase income tax to pay for it? Where did Boris Johnson get the money to line the pockets of his chums during Covid - including the money for Michelle Mone’s “Trust Fund”? Did he increase VAT to pay for it?

A government is not a household

Unfortunately you and I can’t print money - though it would be nice!

As well, as X-Ray Specs, See-Back-A-Scopes and Personal Hovercraft, comics in the 1950s/60s were full of ads for money printing machines!

The only thing that can create money is the government - in fact it has a factory that prints the stuff in Debden, Essex! Today, most money is created electronically.

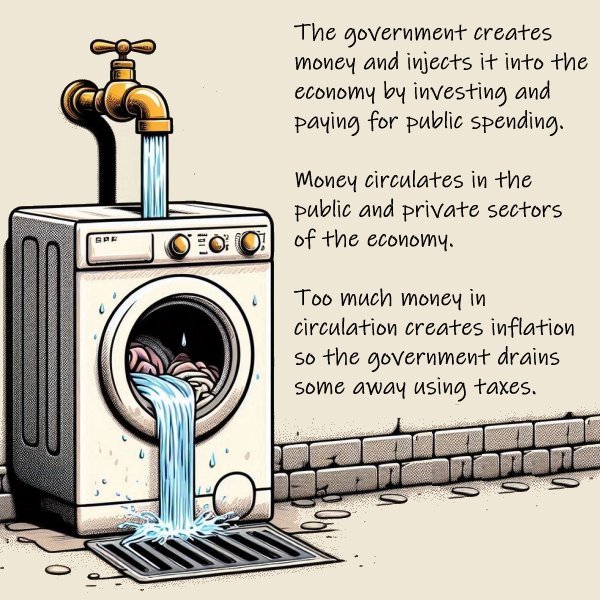

Just to state the obvious - government creates money and, along with local authorities, spends it on almost every aspect of our society: doctors, nurses, teachers, hospitals, roads, railways, police, army, navy, air force, weapons of mass destruction, nuclear power stations, social housing, bin collection, care homes, unemployment benefit, old age pensions, subsidies to industry, environmental protection - the list is almost endless.

There is no corner of the economy that isn’t affected, directly or indirectly, by government spending.

There is no such thing as a free lunch

You can’t go on printing money and spending it without causing problems - and the biggest problem is inflation. A small amount of inflation is good for the economy - it encourages spending and promotes growth. However, too much inflation (much above 2%) results in price increases, falling living standards and general unrest - unless people are entertained by beer and circuses, encouraged to find scapegoats and conned by the millionaire-owned mass media into accepting it.

Tax, taking money out of the economy, is the tool government uses to control inflation.

Reasons to tax

To control inflation.

To give value to the currency.

The government only accepts pounds as tax payment so people and businesses have to acquire pounds from somewhere before they can pay tax.

To create a fair society by reducing inequality.

To prevent abuse (“sin taxes” on alcohol and tobacco)

To encourage investment in the “right” sort of things - things beneficial to society.

To reinforce the social contract.

The government is responsible for spending in the best interests of society and citizens are responsible for contributing to society by paying tax.

Where would we be without government spending?

In a mess.

No health service, no education, no security, no social care, no bin collection, no roads no almost everything!

Where would we be without tax?

In a mess.

Too much money sloshing around.

Rampant inflation/

Massive increase in the wealth gap.

Think of it this way

Debt? What debt?

“The government is at the mercy of the bond market.”

“The government can’t afford to borrow any more.”

“The market will crash the pound.”

When we open a current account with a High Street bank we don’t see it as them borrowing from us, we see it as us saving with them

The UK government doesn’t “borrow”, it provides a savings scheme for those who which to save their money securely while earning a reasonable interest.

I save with National Savings (part of the “National Debt”) because they pay a good rate of interest and they are 100% secure - unlike savings in banks as we found out in 2007/8! I admit my share is tiny but people like me currently hold over £240,000,000,000, £240 billion, in National Savings and therefore in the “National Debt”. We don’t want it back, we want it kept securely.

Pension funds save with the government for the same reason. Their share is quite large - about £500,000,000,000 - half a trillion pounds! They don’t want it back, they want it kept securely - with interest.

Insurance companies save with the government for the same reason. Their share is also quite large - about £178,000,000,000. £178 billion. They don’t want it back until they really need it - and even then, their savings are long term so they can’t take it out at short notice.

Foreign governments save with the UK government because they know their savings are secure. They also save for the long term - 10 to 30 years - so they can’t take it out on whim!

The UK can’t go bust as long as it has a sensible government that balances investment with taxation to prevent inflation. Truss crashed the pound because she wanted to give money away without any balance.

The “financial market” that governments are so afraid of, are dependent on the willingness of government to provide a safe haven for cash. Financial markets don’t create wealth, they are parasites on the backs of those who do and they could not exist without secure government savings.

So what do we need?

A government that:

recognises that it is sovereign and controls its own currency.

recognises that it must invest for the benefit of society.

prioritises investment in areas that do the most social good - not weapons of mass destruction or trying to police the world in the interests of big business.

uses spending and taxation to create a fairer society.

is not obsessed with made-up “fiscal rules” and the power of the “financial market”.

keeps things under control with a fair system of taxes where those with the most contribute the most.

scraps 90% of our tax system and implements taxes that are simple to understand, fair and impossible to avoid.

implements Land Value Tax - with no exceptions.

is free of corruption by not accepting “donations” or freebies.